In this modern age, many businesses need to be able to do business online quickly.

Many sites let you pay for things online, but Deposyt is one of the best because it is quick and safe. Anyone can use Deposyt. It even works for small businesses that want to make it easy for customers to pay. People who want an easy way to send and receive money can use it.

In this world, deals happen in the blink of an eye, and all funds are encrypted to keep them as safe as possible. It only takes a click to get help from customer service.

It is what Deposyt, a tool that many people worldwide already believe in, says it can do.

What is Deposyt?

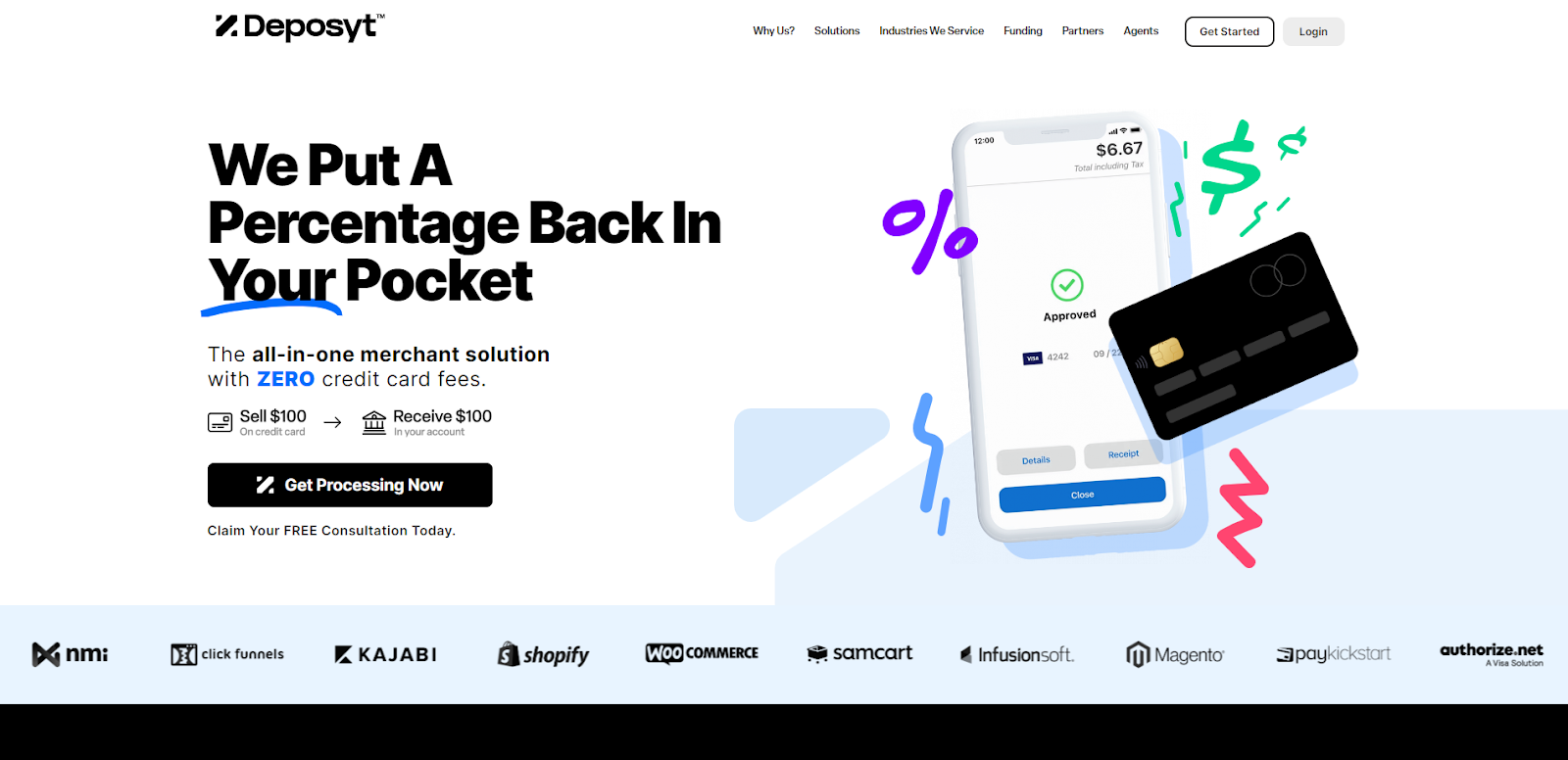

Source: Deposyt

The unique Deposyt tool makes it easier to do business with banks worldwide. It uses cutting-edge technologies to make the processes easier for depositors and receivers.

The easy-to-use interface of this makes moves quick, safe, and straightforward. It has strict security methods that keep your money and personal information secure.

Because Deposyt is open, users can always see what purchases they have made. Deposyt can be used for both personal and business payments. Its rising financial appeal shows that it works and can be trusted.

Features and Benefits of Using Deposyt

Source: Deposyt

Deposyt presents a cutting-edge payment system designed for the digital age. It facilitates swift online transactions, allowing users to make payments online with ease. With robust security measures in place, all online sales, personal data, and transaction details remain protected.

The platform’s intuitive design ensures even those new to online payments can navigate and accept credit card payments effortlessly. Users can stay informed and feel secure as the system provides real-time tracking of all transactions, highlighting any associated fees transparently.

It stands out in facilitating international payments, making it a top choice for businesses dealing with overseas counterparts. This emphasis on speed, security, and user-friendliness solidifies it’s position as a leader in financial technology.

Security Measures in Deposyt

In the world of online transactions, platforms like Deposyt prioritize security, especially when acting as a credit card processor. It encrypts all orders and payment information, demonstrating its commitment to ensuring the safety of its users.

Multi-factor authentication (MFA) is deployed, adding an extra layer of protection, ensuring only authorized individuals gain access. Periodic security audits are conducted, ensuring that vulnerabilities are identified and addressed promptly.

In collaboration with leading security experts and merchant service providers, it constantly adapts to counter emerging threats. The platform offers tools and resources to empower business owners to secure their credit and debit card transactions. With its comprehensive range of payment safety measures, it stands out as a trusted and secure option for managing a wide range of payments online.

Ease of Integration

Source: Canva Premium

In the rapidly evolving digital landscape, seamless integration is the key to efficiency and user satisfaction. Deposyt, with its forward-thinking approach, ensures that online businesses can effortlessly automate and incorporate its services. Here’s a detailed guide to help you navigate the integration process:

Step-by-Step Guide on Integrating Deposyt with Online Businesses:

- Initial Setup: Begin by registering your business on the Deposyt platform. Ensure you have all the necessary details, including business credentials and banking information.

- API Access: Once registered, navigate to the ‘Developer’ section to access your unique API key. This key will allow your website or application to communicate with it.

- Platform Selection: Choose the e-commerce platform your business operates on. Deposyt supports a wide range of media, ensuring compatibility for all users.

- Plugin Installation: For platforms like Shopify or WooCommerce, search for the Deposyt plugin in their respective app stores. Install and activate the plugin.

- Configuration: Within the plugin settings, input your API key and customize the payment gateway settings per your business needs.

- Testing: Before going live, conduct a few test transactions to ensure the integration is functioning correctly. It provides a sandbox environment for this purpose.

- Go Live: Once satisfied with the test results, switch from the sandbox to the live environment. Your online business is now ready to accept payments through Deposyt!

Supported E-commerce Platforms and APIs:

Deposyt prides itself on its versatility, offering support for many e-commerce platforms. Some of the major platforms include:

- Shopify: Renowned for its user-friendly interface, integrating Deposyt with Shopify is a breeze. Install the Deposyt app from the Shopify store and follow the on-screen instructions.

- WooCommerce: As a popular choice for WordPress users, WooCommerce integration is straightforward. The Deposyt plugin is available in the WordPress repository.

- Magento: For businesses operating on Magento, Deposyt offers a dedicated extension to ensure smooth transactions.

- BigCommerce: With its growing popularity, BigCommerce users can benefit from Deposyt’s seamless integration.

Pricing and Fees of Deposyt: Online Payment Processing

Source: Deposyt

Deposyt is a payment gateway that offers lower credit card processing fees than traditional processors. Their pricing is based on a tiered system, with lower rates for higher-volume merchants.

Pricing:

- In-person payments: 2.5% + 10 cents per transaction

- Online payments: 2.9% + 30 cents per transaction

- Keyed-in payments: 3.5% + 30 cents per transaction

Fees:

- Monthly fee: $0 (for merchants processing over $20,000 per month)

- Setup fee: $299

- Chargeback fee: $25

Deposyt also offers several additional features, such as:

- Recurring payments: 2.9% + 30 cents per transaction

- ACH payments: 0.5% + 30 cents per transaction

- Fraud prevention tools: Free

- Reporting and analytics: Free

Deposyt’s pricing is generally lower than traditional processors, especially for high-volume merchants. However, it is essential to note that they do have a setup fee and chargeback fee.

Hidden Fees to Watch Out For:

While Deposyt champions transparency, it’s always wise for users to be vigilant. Here are some potential fees to be aware of:

- Currency Conversion: If your business deals with international transactions, consider currency conversion rates. While Deposyt offers competitive rates, it’s essential to factor these into your costs.

- Chargebacks: In the rare event of a disputed transaction, there might be a chargeback fee. This is standard across the industry and is something businesses should be prepared for.

- Inactivity Fees: Ensure your account remains active. Some platforms impose costs on dormant accounts, so it’s crucial to check Deposyt’s terms.

- Early Termination: If you’re on a contract and decide to terminate early, there might be associated fees. Always read the fine print before making such decisions.

How Deposyt Stands Out from Competitors in Payment Process Transaction

Source: Canva Premium

It can take time to pick the right online payment service provider in the crowded market. Each site claims to have its unique features and make transactions easy. Deposyt, on the other hand, has found a way to stand out from its rivals. Let us look at what makes Deposyt different and why many businesses choose it over others.

Comparison with Other Leading Payment Providers

- User Experience: Many platforms offer a myriad of functions but can be challenging to navigate. Deposyt stands out with its user-friendly payment process, making it effortless for beginners. Its simplicity, combined with effective features, streamlines the online payment processing experience.

- Global Reach: While only certain payment processing services operate worldwide, Deposyt breaks these boundaries. By integrating with payment processors like Stripe, it provides universal payment methods, allowing businesses and customers globally to handle card payments with ease.

- Customization: Deposyt recognizes that one size doesn’t fit all. Instead of confining businesses to a rigid platform, it offers them the flexibility to customize their payment gateway. This means firms can seamlessly integrate Deposyt’s payment processing service, making transaction records and payment gateways appear as though they are native to their website.

- Security: Safety is paramount in the world of online payments. While many prioritize it, Deposyt elevates the standard. With advanced encryption and vigilant tracking, Deposyt ensures that every transaction is not only smooth but also secure.

Why Deposyt is the Preferred Choice for Many Businesses

- Transparent Pricing: Unlike many processing services, Deposyt stands out with its transparent pricing, ensuring merchants get the best payment rates. This clarity allows businesses to budget efficiently, ensuring they don’t incur unnecessary credit card payments costs.

- Solid Support: When operating an online store, having reliable merchant service support is crucial. Deposyt’s dedicated team is always on standby, ready to assist. Whether you have questions about card transaction features or face any technical hitches, a solution is just a click away.

- Scalability: A business’s payment needs evolve as it grows. Deposyt offers a flexible payment solution that scales with your enterprise, ensuring that as your online store expands, so do your payment options.

- Innovative Features: Staying ahead in the e-commerce game requires continuous innovation. Deposyt consistently introduces new features, such as AI-driven fraud detection and compatibility with emerging e-commerce platforms, to provide a comprehensive payment experience.

Final Thoughts

It can be hard to determine which online payment service to use, but Deposyt has made itself stand out. Every product and service it provides shows that it cares about the user experience, security, and new ideas.

As companies change in the digital age, having a trustworthy partner like Deposyt is no longer a nice to have; it’s a must. If you’ve been looking for the best, Deposyt could end your search.

When discussing the best solutions, check out our post about the 85 best automation software for your business! You will learn about other AI tools that are changing how businesses work. Jump in and give your company the tools of tomorrow today!

Visit our blog to learn more about AI software solutions.

FAQs: Online Payment Gateway

What is the best online payment processing service available?

While the “best” service often depends on individual needs, many consider payment deposyt as one of the best online payment processing services due to its transparent pricing and best payment toolkit.

Why is it said that Payment Depot doesn’t charge like others?

Payment depot often stands out because they don’t charge some of the high fees that other payment processing companies might. This can lead to savings for businesses, especially when dealing with a high volume of transactions.

How do I choose the best payment gateway for my business?

To choose the best payment gateways, you should consider factors like payment processing fees, whether the provider offers in-store and online options, the range of payment methods supported, and any associated payment gateway fees.

Do all payment processors offer mobile payment solutions?

While most modern payment processing companies offer mobile payment solutions, it’s always a good idea to check with a specific provider. An all-in-one payment system will typically provide both online and in-person, including mobile, options.

What is the difference between a payment gateway and a merchant account?

A payment gateway facilitates online credit card payments by transmitting the payment information to the payment processor. In contrast, a merchant account is where funds are held before they’re transferred to a business bank account. Many payment gateway providers offer both services, but they can be separate.

Do I need a separate service provider in the US to accept international credit cards?

Not necessarily. Many popular payment processors offer the capability to accept international credit cards. However, it’s essential to ensure the provider offers a variety of payment options suitable for your target audience, both domestic and international.

Are payment processing fees consistent across all companies?

No, payment processing fees can vary depending on the payment processor and the type of transaction (e.g., online, in-store, mobile). Some providers might charge a flat fee, while others could have a percentage-based fee. It’s always advisable to thoroughly research and compare to get the best options.

What should a small business look for in a payment processing service?

Small businesses should look for payment processing for small businesses that offer a blend of affordable fees, a range of payment methods, and strong security measures compliant with the payment card industry standards.

Do I need a payment processor to accept online payments?

Yes, to accept credit card payments online or any other form of online payment, you would need an online payment processing service or a third-party payment system.

Which processors are best for fast-growing businesses?

Fast-growing businesses should look for payment processors that offer scalability, low processing fees, and a robust toolkit to handle a mix of in-store, online, and mobile payments. It’s crucial to evaluate the best payment processing companies for small businesses and those best suited for expansion and growth.