Having the right tools can make all the difference for businesses and accounting professionals. Today, we provide a comprehensive guide to the top 37 CPA software solutions transforming the industry. We aim to help you navigate the world of CPA software, making finding the perfect fit for your unique needs easier. So, let’s dive in and explore the various options that await you!

Key Takeaways

- Choosing the right cloud-based software helps CPAs efficiently manage finances, ensure software accuracy, and streamline tax preparation.

- During tax filing season, having reliable software perform calculations can reduce errors and improve compliance with ever-changing tax laws.

- The best CPA tax tools simplify how professionals handle much tax data, automate processes, and effectively oversee tax submissions for clients.

Zoho Books

Zoho Books is a small business accounting software option offering various accounting features, including income and expense tracking, financial reporting, and customer relationship management. This software is designed specifically for small businesses, offering a user-friendly interface and customizable dashboards that allow small business owners to track their financial data easily.

- Contact their customer support

A unique and powerful suite of software to run your entire business, brought to you by a company with the long-term vision to transform the way you work.

QuickBooks

As one of the best accounting software options available, QuickBooks is designed to help small businesses efficiently manage their financial data. With income and expense tracking, expense tracking, financial reporting, and inventory management features, this software is ideal for small business owners who want to streamline their accounting services. QuickBooks Online also offers sales tax tracking and the ability to manage multiple businesses from a single account, making it an incredibly versatile option for small business accounting software.

- $1 for 6 months

Create and send professional invoices with smart invoicing software. Get payroll done right, and payroll taxes done for you.

Xero

Xero is another great CPA software option for small business owners. With features like expense tracking, financial reports, and customer relationship management, Xero is designed to help businesses stay on top of their financial data while maintaining strong customer relationships. Additionally, Xero offers an inventory management feature that allows companies to track their inventory levels and create purchase orders as needed.

Price Plan

- Starter: $25/month

- Standard: $40/month

- Premium: $54/month

Sage

Sage Business Cloud Accounting is an accounting software option offering various accounting features, including income and expense tracking, financial reporting, and customer relationship management. This software is designed specifically for small businesses, offering a user-friendly interface and customizable dashboards that allow small business owners to track their financial data easily.

Price Plan

- $7.50/month

FreshBooks

FreshBooks is an easy-to-use accounting software option that offers a range of accounting features, including income and expense tracking, financial reporting, and customer relationship management. This software is ideal for small businesses, offering a user-friendly interface and customizable dashboards that make it easy to manage financial data.

Price Plan

- Lite: $8.50/month

- Plus: $15/month

- Premium: $27.50/month

Wave Accounting

Wave Accounting is a free accounting software option offering various accounting features, including income and expense tracking, financial reporting, and customer relationship management. This software is ideal for small businesses just starting, as it offers a user-friendly interface and customizable dashboards that make it easy to manage financial data.

Price Plan

- Starts at $40/month

Kashoo

Kashoo is a small business accounting software option offering various accounting features, including income and expense tracking, financial reporting, and customer relationship management. This software is designed specifically for small businesses, offering a user-friendly interface and customizable dashboards that allow small business owners to track their financial data easily.

Price Plan

- $216/year

ProSeries

ProSeries is a tax software developed by Intuit, the company behind QuickBooks and TurboTax. The software is designed for professional tax preparers and offers a comprehensive suite of tools. It is known for its ability to handle complex tax scenarios, making it an ideal choice for small to medium-sized accounting firms. It offers features like automated calculations, error-checking, e-filing, and an extensive forms library.

Price Plan

- Starts at $389/year

Lacerte

Also developed by Intuit, Lacerte is a powerful, feature-rich tax preparation software designed for professional accountants. It can handle complex tax situations and is particularly suited for larger accounting firms. Lacerte offers detailed diagnostics, robust integrations with other Intuit products, and various forms to cover a broad range of tax situations.

Price Plan

- Contact them for pricing

ATX Tax

ATX Tax is a professional tax preparation software catering to small and large accounting firms. It is recognized for its user-friendly interface and extensive forms library. ATX provides:

- Comprehensive coverage for all states.

- Robust tax content.

- Powerful time-saving features.

- Ongoing training and support.

Price Plan

- $3,319 one time payment

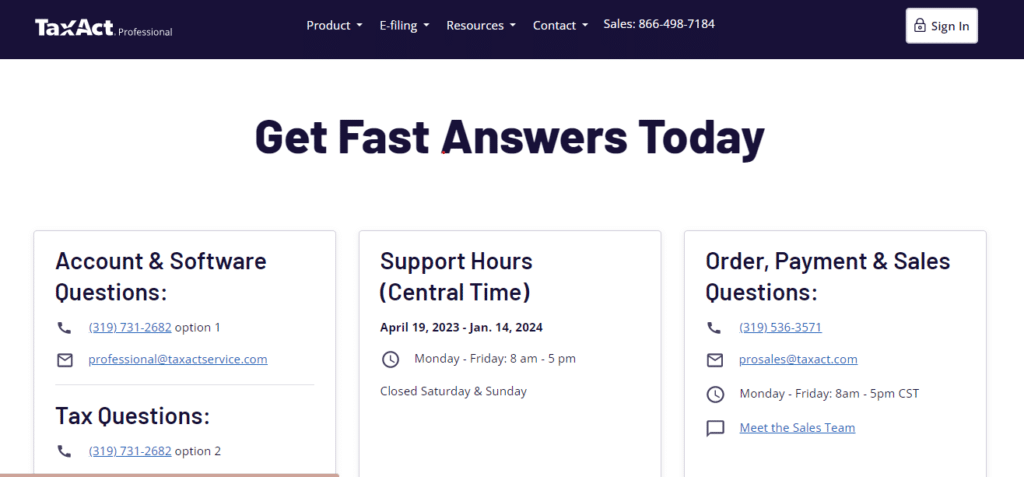

TaxAct Professional

TaxAct Professional is a tax preparation software designed for tax professionals dealing with individuals, businesses, and state returns. It offers features like tax organizer templates, tax planner scenarios, and a robust e-filing system. TaxAct Professional is known for its affordability, ease of use, and excellent customer support.

Price Plan

- $20 per E-file

CCH Axcess Tax

CCH Axcess Tax, from Wolters Kluwer, is a cloud-based professional tax software. It is designed to streamline tax preparation and compliance through automation and centralization of processes. CCH Axcess Tax is often praised for its robust features, including automatic updates, built-in diagnostics, and comprehensive coverage of tax returns. It also seamlessly integrates with other CCH Axcess modules like Document, Portal, and Practice for a complete end-to-end solution.

Price Plan

- Contact their customer support

Thomson Reuters CS Professional Suite

Thomson Reuters CS Professional Suite is a CPA software option designed to help accounting professionals manage their client’s financial data. With features like income and expense tracking, financial reporting, and sales tax tracking, Thomson Reuters CS Professional Suite is ideal for accounting professionals who want to streamline their accounting services.

TaxSlayer Pro

TaxSlayer Pro is a CPA software option that is designed to help accounting professionals manage their client’s financial data. With features like income and expense tracking, financial reporting, and sales tax tracking, TaxSlayer Pro is ideal for accounting professionals who want to streamline their accounting services.

Price Plan

- Pro Premium: $1,595

- Pro Web: $1,495

- Pro Web + Corporate: $1,895

TimeWise

TaxWise is a professional tax preparation software developed by Wolters Kluwer. It is designed for tax professionals and offers a range of features like e-filing, error diagnostics, and return storage. TaxWise is known for its comprehensive coverage of tax scenarios, making it suitable for many tax professionals.

Price Plan

- Request for a consultation

Practice Ignition

Practice Ignition is a small business accounting software option offering various accounting features, including income and expense tracking, financial reporting, and customer relationship management. This software is designed specifically for small businesses, offering a user-friendly interface and customizable dashboards that allow small business owners to easily track their financial data.

Price Plan

- Starter: $69/month

- Professional: $149/month

- Scale: $369/month

Canopy

Canopy is a small business accounting software option offering various accounting features, including income and expense tracking, financial reporting, and customer relationship management. This software is designed specifically for small businesses, offering a user-friendly interface and customizable dashboards that allow small business owners to easily track their financial data.

Price Plan

- $50 per user/month

Jetpack Workflow

Jetpack Workflow is a small business accounting software offering various accounting features, including income and expense tracking, financial reporting, and customer relationship management. This software is designed specifically for small businesses, offering a user-friendly interface and customizable dashboards that allow small business owners to easily track their financial data.

Price Plan

- Organize: $36/month

- Scale: $39/month

Karbon

Karbon is a small business accounting software offering various accounting features, including income and expense tracking, financial reporting, and customer relationship management. This software is designed specifically for small businesses, offering a user-friendly interface and customizable dashboards that allow small business owners to easily track their financial data.

Price Plan

- Team: $59/month

- Enterprise: $79/month

- Business: Custom pricing

Senta

Senta is a small business accounting software option offering various accounting features, including income and expense tracking, financial reporting, and customer relationship management. This software is designed specifically for small businesses, offering a user-friendly interface and customizable dashboards that allow small business owners to easily track their financial data.

Price Plan

- £25.60 per month

TaxDome

TaxDome is a small business accounting software option offering various accounting features, including income and expense tracking, financial reporting, and customer relationship management. This software is designed specifically for small businesses, offering a user-friendly interface and customizable dashboards that allow small business owners to easily track their financial data.

Price Plan

- Lite: $33/month

- Pro: $50/month

AccountancyManager

AccountancyManager is a small business accounting software option offering various accounting features, including income and expense tracking, financial reporting, and customer relationship management. This software is designed specifically for small businesses, offering a user-friendly interface and customizable dashboards that allow small business owners to easily track their financial data.

Price Plan

- £31.20 per user/month

Liscio

Liscio is a small business accounting software option offering various accounting features, including income and expense tracking, financial reporting, and customer relationship management. This software is designed specifically for small businesses, offering a user-friendly interface and customizable dashboards that allow small business owners to track their financial data efficiently.

Price Plan

- $40/month

A2X

A2X is a small business accounting software option offering various accounting features, including income and expense tracking, financial reporting, and customer relationship management. This software is designed specifically for small businesses, offering a user-friendly interface and customizable dashboards that allow small business owners to easily track their financial data.

Price Plan

- Starts at $19/month

MYOB AccountRight

MYOB AccountRight is a comprehensive and powerful accounting software solution for small to medium-sized businesses and accountants, including Certified Public Accountants (CPAs). It offers cloud-based and desktop-based options, allowing users to work seamlessly online or offline.

Price Plan

- Lite: $15/month

- Pro: $27.50/month

- Plus: $68/month

- Premier: $85/month

Reckon One

Reckon One is a cloud-based accounting software solution for small businesses and accounting professionals, including Certified Public Accountants (CPAs). It is known for its modular approach, allowing users to add or remove features as needed, making it a more cost-effective option for businesses with varying needs.

Price Plan

- The Basics: $6/month

- Essentials: $16.50/month

Bloomberg Tax

Bloomberg Tax is a comprehensive tax management solution that simplifies the tax process for CPAs and accounting firms. It offers various tools and resources, including tax research, planning, and compliance support. Bloomberg Tax also integrates with other software to facilitate seamless data exchange, ensuring a smooth and efficient tax workflow.

Price Plan

- You can request a customized quote

Vertex Cloud Indirect Tax O Series

Vertex Cloud Indirect Tax O Series is a cloud-based tax automation software that helps CPAs accurately calculate, validate, and manage indirect taxes such as sales, use, and value-added taxes (VAT). Its user-friendly interface and real-time tax rate updates ensure you stay on top of tax regulations and maintain compliance.

Price Plan

- Vertex offers a pay-as-you-go pricing model, with the cost based on the number of transactions processed. You’ll need to contact their sales team to get a detailed quote.

TaxJar

TaxJar is a popular sales tax software that automates tax filing and remittance for CPAs and businesses. It features seamless integration with major e-commerce platforms and payment processors, enabling companies to collect accurate sales tax and generate ready-to-file returns.

Price Plan

- Starting at $19 per month for the Basic plan, scaling up to custom pricing for enterprises based on their specific needs.

Oracle Hyperion Tax Provision

Oracle Hyperion Tax Provision is a powerful tax management solution that streamlines tax reporting and compliance for global organizations. It offers a centralized platform to automate tax provision calculations and generate detailed reports, ensuring accuracy and efficiency. As part of the Oracle suite, it can integrate with other Oracle applications to consolidate financial data.

Price Plan

- You’ll need to contact their sales team to discuss your requirements and obtain a quote.

Sovos Tax Compliance

Sovos Tax Compliance is a comprehensive tax software solution that simplifies business compliance across multiple jurisdictions. It covers various tax types, including sales and use, VAT, and excise taxes. Sovos also offers regulatory analysis and reporting capabilities to help CPAs stay updated on the latest tax laws and requirements.

Price Plan

- Contact their sales team

GoSystem Tax RS

GoSystem Tax RS by Thomson Reuters is a web-based tax software designed for accounting firms and tax professionals. It supports various tax types and forms, including individual, corporate, partnership, and nonprofit tax returns. GoSystem Tax RS offers seamless integration with other Thomson Reuters software and e-filing capabilities.

Price Plan

- Contact their sales support

CorpTax

CorpTax is a tax software solution specifically designed for corporate tax departments. It streamlines corporate tax workflows by offering a comprehensive suite of tax provisions, compliance, planning, and data management tools. CorpTax supports various tax types, including income, sales and use, property, and VAT.

Price Plan

- Contact their sales team

Taxfiler

Taxfiler is a cloud-based tax software solution designed for accounting professionals in the United Kingdom. It supports various tax types, including individual, partnership, corporate, and trust tax returns. Taxfiler also provides features such as practice management, document storage, and integration with accounting software like QuickBooks and Xero.

Price Plan

- Starts at £10 per month for the Sole Practitioner package

PITBULLtax

PITBULLtax is a web-based tax resolution software for tax professionals dealing with IRS collections and resolution cases. It offers tools to help tax professionals manage and resolve tax issues, including offers in compromise, installment agreements, and penalty abatement. PITBULLtax also provides features such as document management, a client portal, and integration with other tax software.

Price Plan

- The Essentials package costs $89 per month, with additional options and packages available based on your needs.

CrossLink Professional Tax Software

CrossLink is a professional tax software designed for tax preparers and accounting professionals. It supports various tax forms, including individual, business, and nonprofit tax returns. CrossLink provides features such as e-filing, bank product integration, and customizable reporting. It also includes a user-friendly interface to simplify tax preparation and filing.

Price Plan

- Reach out to their sales team

AvaTax

AvaTax is a cloud-based sales tax automation solution designed to help businesses and accounting professionals accurately calculate sales tax rates, manage exemptions, and file tax returns. It integrates with popular e-commerce platforms, ERP systems, and accounting software to streamline the tax compliance process.

Price Plan

- Contact their customer support

BTCSoftware

BTCSoftware is a UK-based tax and accounting software provider that offers a range of solutions for accounting professionals, including tax return preparation, accounts production, and practice management. The software supports various tax types, including individual, partnership, corporate, and trust tax returns. BTCSoftware also provides integration with popular accounting platforms like QuickBooks and Xero.

Price Plan

- Contact their sales team

TurboTax Business

TurboTax Business is a tax software solution designed to prepare business tax returns, including C corporations, S corporations, partnerships, and multi-member LLCs. It offers a user-friendly interface, step-by-step guidance, and e-filing capabilities to simplify tax preparation.

Price Plan

- Pricing for TurboTax Business starts at $159.99 per return

Conclusion

Finding the right CPA tax software can make all the difference in streamlining tax preparation and ensuring compliance. The best tools combine tax expertise with automation, making it easier to manage complex filings and handle local tax returns efficiently.

Have you considered how the right software can support both individuals and experienced tax experts in simplifying tax processes? Whether you’re a tax adviser assisting clients or an individual preparing for preparation season, having the right technology can save time and reduce errors.

Start exploring the best CPA tax software today to simplify filing your taxes and improve accuracy in financial management. You can also read our other informative blogs to learn more about CPA software and subscribe to enjoy the hottest deals and discounts on selected software.

FAQs

What Is Tax Preparation Software and How Does It Assist Accounting Firms?

Tax preparation software is a specialized tool designed to help accountants and tax preparers efficiently manage the tax preparation process. It streamlines tasks such as data entry, calculations, and filing, allowing accounting firms to provide faster and more accurate service during tax season.

What Are Some of the Best Tax Preparation Software Options for CPAs and Accounting Firms?

Some of the best tax preparation software for CPAs and accounting firms include Drake Tax, Lacerte Tax, Intuit ProSeries Tax, and ProConnect Tax. Each of these software solutions offers unique features tailored for accounting practices, making them top choices in the software market.

Does Drake Tax Offer a Free Trial for New Users?

Yes, Drake Tax provides a free trial for new users, allowing them to evaluate the software’s features and functionalities before making a commitment. This is particularly beneficial for accounting firms that are considering adopting new tax management software.

How Can Tax Preparation Software Enhance the Tax Management Process for an Accounting Firm?

Tax preparation software enhances the tax management process by automating calculations, simplifying the electronic filing of federal tax returns, and ensuring compliance with current tax laws. This efficiency allows accountants to focus more on tax planning and strategy for their clients.

What Features Should I Look for in the Best Tax Preparation Software for Small Businesses?

When selecting the best tax preparation software for small businesses, look for features such as user-friendly interfaces, comprehensive tax planning tools, support for electronic filing, and the ability to handle various tax deductions. Software solutions like Intuit ProSeries Tax and Drake Tax are known for their robust offerings in these areas.

Can Accounting Firms Use Tax Preparation Software to Manage Previous Tax Returns?

Yes, many tax preparation software options, such as Lacerte Tax and ProConnect Tax, allow accounting firms to access and manage previous tax returns. This feature is essential for tax preparers who need to reference past filings for their clients during the preparation process.

What Are the Advantages of Using Desktop Software Versus Cloud-Based Tax Preparation Software?

Desktop software, like Drake Tax, often provides robust functionality and speed, while cloud-based tax preparation software offers flexibility and mobility, allowing users to access their accounts from anywhere. The choice between the two depends on the specific needs of the accounting firm, such as team size and workflow preferences.

How Do I Determine Which Tax Preparation Software Is the Best for My Accounting Practice?

To determine the best tax preparation software for your accounting practice, consider factors such as the specific features you need (e.g., tax planning, electronic filing), user reviews, pricing, and the software’s ability to integrate with other accounting and management software. Conducting a tax software survey can also help identify the top options available.

Are There Any Specific Tax Preparation Software Solutions Recommended for Those Starting Their Tax Practice?

For individuals starting a tax practice, user-friendly software solutions like Intuit ProSeries Tax and Drake Tax are often recommended. These programs provide essential features and support that cater to new tax preparers, making it easier to navigate the complexities of the tax preparation process.